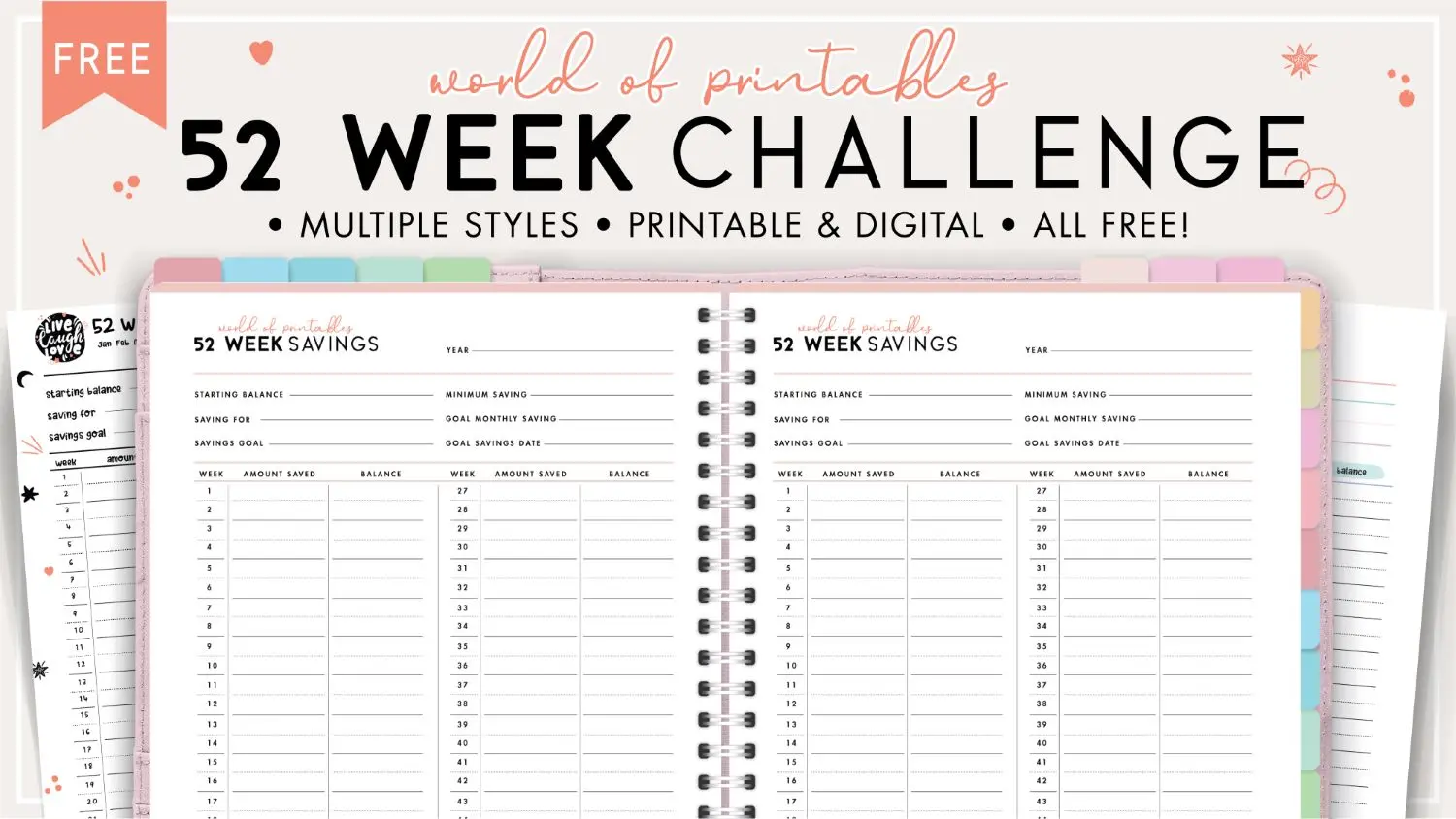

What Is the 52-Week Money Saving Challenge?

Before we explore the Asian adaptations, let’s understand the basic concept of this viral savings method. The traditional 52-Week Money Saving Challenge is brilliant in its simplicity, designed to build momentum and make saving a consistent habit throughout the year.

1. The Traditional Method Explained

The classic challenge is very straightforward. In Week 1, you save $1. In Week 2, you save $2, and so on.

You continue this pattern for 52 weeks. In the final week, you save $52.

By the end of the year, you will have saved a total of $1,378. This is the core idea of the 52-Week Money Saving Challenge.

2. The Psychology Behind Its Success

The challenge works because it starts incredibly small. Saving just $1 in the first week feels effortless.

This easy start helps build a positive habit. As the amount gradually increases, your commitment grows stronger.

It turns saving into a rewarding game. This makes the 52-Week Money Saving Challenge more engaging than traditional saving methods.

3. The Main Drawback of the Traditional Model

The biggest challenge comes at the end of the year. You have to save the largest amounts during December.

This often coincides with major holidays and increased spending. Like Christmas, New Year, or Lunar New Year preparations in Asia.

This is why adapting the 52-Week Money Saving Challenge is so important for long-term success.

Adapting the 52-Week Money Saving Challenge for Asia

To make this challenge practical for professionals across Asia, we need to customize it. This involves adjusting for different currencies, income levels, and cultural spending patterns. This is the core of our Asian Edition of the 52-Week Money Saving Challenge.

1. Customizing for Local Currencies

Saving 1 SGD is very different from saving 1,000 IDR. The first step is to choose a starting increment that makes sense for your local currency.

For example, in the Philippines, you might start with 50 PHP. In Malaysia, you could start with 5 MYR.

Choose a small, manageable amount. This ensures the 52-Week Money Saving Challenge feels achievable from the start.

2. The Reverse 52-Week Money Saving Challenge

This is a popular and highly effective variation. You simply do the challenge in reverse order.

In Week 1, you save the largest amount (e.g., $52). In Week 52, you save the smallest amount (e.g., $1).

This approach gets the hardest part over with first. It also frees up cash during the expensive holiday season at the end of the year.

3. The Bi-Weekly or Monthly Variation

Many professionals in Asia are paid monthly, not weekly. A weekly savings plan can be hard to track.

You can adapt the 52-Week Money Saving Challenge to a monthly schedule. Simply add up the four or five weekly amounts for each month and save that total.

For example, in Month 1 (Weeks 1-4), you would save $1+$2+$3+$4 = $10. This simplifies the process.

4. The “Pick Your Own Amount” Method

This flexible approach is great for those with variable incomes. Create a chart with all 52 amounts, from $1 to $52.

Each week, you look at your finances and decide which amount you can afford to save. Then you cross it off the list.

This gives you control and flexibility. It makes the 52-Week Money Saving Challenge adaptable to your financial situation.

Your Step-by-Step Guide to Starting the Challenge

Feeling motivated? Let’s get you started on your savings journey. Following these simple steps will set you up for success with the 52-Week Money Saving Challenge.

1. Step 1: Choose Your Challenge Version

Decide which version of the challenge you want to follow. Will it be the traditional, reverse, or pick-your-own-amount method?

Also, decide on your starting increment. Make sure it’s a realistic amount for your budget.

This initial decision is crucial for the success of your 52-Week Money Saving Challenge.

2. Step 2: Set Up a Separate Savings Account

Do not mix your challenge money with your regular savings. Open a new, separate high-yield savings account.

This makes it easy to track your progress. It also reduces the temptation to spend the money you’ve saved.

Keeping the funds separate is a powerful psychological trick. It makes your 52-Week Money Saving Challenge feel more official.

3. Step 3: Automate Your Transfers

Set up automatic weekly or monthly transfers to your challenge account. This is the most effective way to ensure consistency.

If you’re doing the “pick your own” method, set a weekly reminder on your phone. This will prompt you to make the manual transfer.

Automation removes the need for constant willpower. It is a key strategy for completing the 52-Week Money Saving Challenge.

Conclusion

The 52-Week Money Saving Challenge is a fantastic tool for building a consistent savings habit. By adapting it to your local currency and lifestyle, as outlined in this Asian Edition, you can set yourself up for success. This challenge makes saving feel less like a chore and more like an exciting year-long game. We at Financial Forms For Asia believe that completing the 52-Week Money Saving Challenge can be the first step toward achieving your larger financial goals. Choose your version and start your 52-Week Money Saving Challenge today!