Why Use a Budgeting App in the First Place?

Before we dive into the specifics of our Budgeting Apps Comparison, let’s establish why using a dedicated app is a game-changer for personal finance. These tools offer significant advantages over traditional methods like spreadsheets or pen and paper.

1. Automation and Convenience

Most budgeting apps can sync directly with your bank accounts. They automatically import and categorize your transactions.

This saves you hours of manual data entry. It provides an up-to-date picture of your finances with minimal effort.

This automation is a key benefit. It makes budgeting less of a chore.

2. Real-Time Financial Overview

With an app, your entire financial life is in your pocket. You can check your budget, track spending, and monitor your goals anytime, anywhere.

This real-time access empowers you to make smarter spending decisions on the go. You’ll know exactly how much you have left in your “dining out” category.

This constant awareness is a powerful feature. It’s a major focus of this Budgeting Apps Comparison.

3. Goal Setting and Tracking

Modern apps go beyond simple expense tracking. They help you set and monitor progress toward your financial goals.

Whether you’re saving for a down payment, a vacation, or retirement. The app can help you create a plan and stay on track.

Visual progress bars and reminders provide motivation. This keeps you engaged with your financial journey.

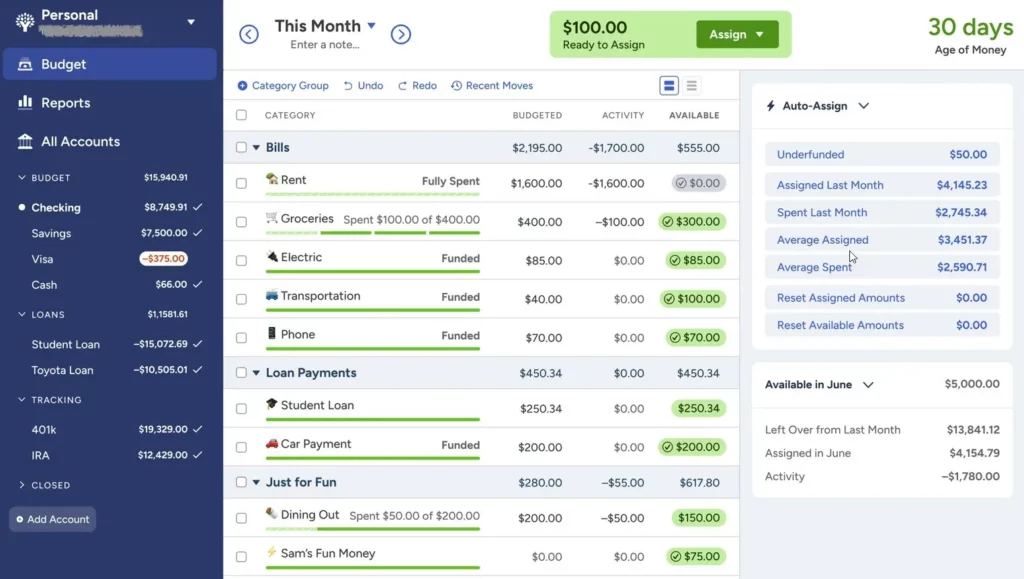

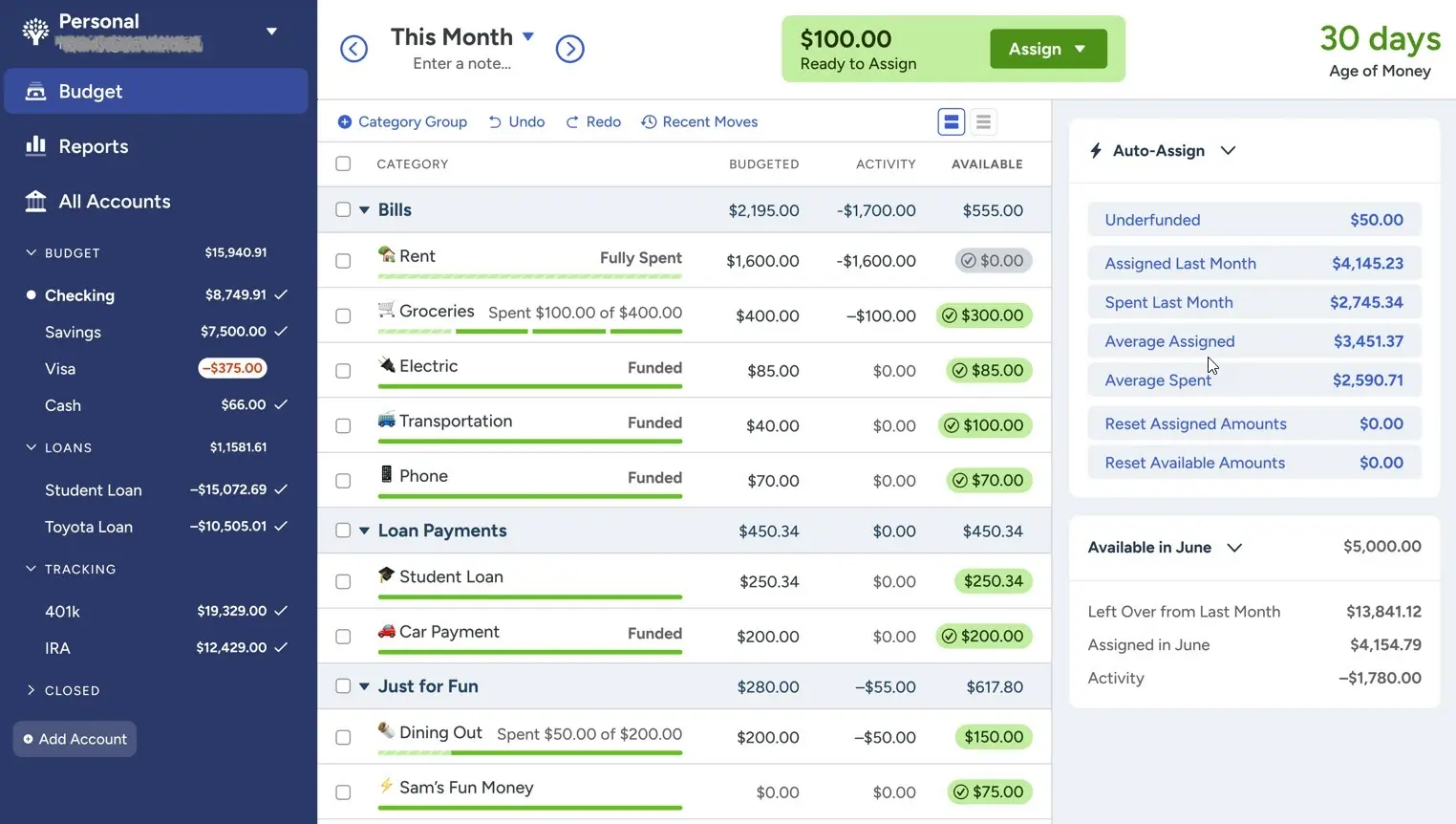

Deep Dive into YNAB (You Need A Budget)

YNAB is more than just an app; it’s a complete financial methodology. It’s built on a proactive, forward-looking approach that has a dedicated, almost cult-like following. This section of our Budgeting Apps Comparison will explore what makes YNAB unique.

1. Core Philosophy: The Four Rules

YNAB operates on four simple rules. Rule One is “Give Every Dollar a Job.” This is a form of zero-based budgeting.

Rule Two is “Embrace Your True Expenses.” This means saving for large, infrequent bills monthly.

Rule Three, “Roll With the Punches,” allows for flexibility. Rule Four, “Age Your Money,” encourages you to spend money that is at least 30 days old.

2. Key Features and User Interface

YNAB’s interface is clean and focused on its four-rule system. It offers robust goal-tracking features and detailed reports.

It has excellent educational resources. Including live workshops, videos, and articles to help you succeed.

The focus is on proactive planning. This makes it a powerful tool in our Budgeting Apps Comparison.

3. Pricing and Who It’s Best For

YNAB is a premium, subscription-based service. It does not have a free version after the initial trial period.

It’s best for people who are serious about changing their financial habits. And are willing to invest time and money into the process.

If you want to be highly hands-on and intentional with your money, YNAB is a top contender.

Exploring Mint: The Free Powerhouse

Mint has been a dominant player in the personal finance space for years, largely because it’s free. It offers a comprehensive overview of your entire financial life. Let’s see how it stacks up in this Budgeting Apps Comparison.

1. Core Philosophy: All-in-One Financial Hub

Mint’s goal is to give you a complete picture of your net worth. It tracks your bank accounts, credit cards, loans, and investments all in one place.

It’s more of a financial monitoring tool than a strict budgeting system. It looks at past spending to help you create a budget for the future.

This “set it and forget it” approach appeals to many users. It’s a key differentiator in this Budgeting Apps Comparison.

2. Key Features and User Interface

Mint’s dashboard is visually appealing, with graphs and charts. It offers features like bill payment reminders and free credit score monitoring.

The app automatically categorizes your transactions. However, you may need to manually correct them from time to time.

Its strength lies in its comprehensive overview. It helps you see the big picture of your finances.

3. Pricing (Free Model) and Who It’s Best For

Mint is free to use. It makes money by recommending financial products like credit cards and loans.

It’s best for people who want a general overview of their finances. And prefer a more hands-off approach to budgeting.

If you’re just starting out and want a free, powerful tool, Mint is an excellent choice in this Budgeting Apps Comparison.

Understanding PocketGuard: The “In My Pocket” Approach

PocketGuard aims to simplify budgeting down to one key question: “How much is in my pocket?” It focuses on your spendable cash after bills and savings. This final section of our Budgeting Apps Comparison looks at this unique approach.

1. Core Philosophy: Simplifying Your Spendable Cash

PocketGuard’s main feature is its “In My Pocket” calculation. It shows you exactly how much money you have left to spend after accounting for bills, goals, and recurring expenses.

This simplifies daily spending decisions. You don’t need to check multiple budget categories.

This focus on simplicity is what makes PocketGuard stand out. It’s a key point in our Budgeting Apps Comparison.

2. Key Features and User Interface

The app has a clean, easy-to-read interface centered around the “In My Pocket” number. It also helps you find opportunities to save by analyzing your recurring bills.

PocketGuard automatically creates a budget for you based on your spending. It’s designed to be very user-friendly for beginners.

Its “Find Savings” feature is a unique selling point. It actively looks for ways to lower your bills.

3. Pricing and Who It’s Best For

PocketGuard offers both a free and a premium version (PocketGuard Plus). The paid version unlocks more features, like creating your own categories.

It’s best for people who feel overwhelmed by traditional budgeting. And just want a simple answer to “Can I afford this?”.

If you want a straightforward, simplified approach, PocketGuard is a strong contender in this Budgeting Apps Comparison.

Conclusion

This Budgeting Apps Comparison shows there is no single “best” app for everyone; the right choice depends on your personality and financial goals. If you want a proactive, life-changing system and are willing to pay, YNAB is unmatched. If you want a free, comprehensive overview of your net worth, Mint is the winner. If you crave simplicity and just want to know what you can spend, PocketGuard is for you. We at Financial Forms For Asia hope this Budgeting Apps Comparison helps you choose the perfect tool to start your journey toward financial mastery.