Why Budgeting for Annual Expenses Is a Game-Changer

Many people excel at managing their monthly bills but get tripped up by expenses that only appear once or twice a year. Understanding the importance of this specific financial skill is the first step in mastering how to budget for annual expenses.

1. Eliminating Financial Stress and Panic

The biggest benefit is the elimination of financial anxiety. You’ll no longer have that sinking feeling when a large bill arrives.

Instead of scrambling to find the money, you’ll have it set aside and ready to go. This creates a profound sense of security and control.

This peace of mind is a primary goal when learning how to budget for annual expenses.

2. Preventing Debt Accumulation

When unprepared for a large expense, many people resort to using credit cards or taking out personal loans. This can lead to a cycle of high-interest debt.

By saving for these costs in advance, you can pay for them in full with cash. This keeps you out of debt and saves you money on interest payments.

Avoiding debt is a critical outcome of knowing how to budget for annual expenses.

3. Protecting Your Monthly Budget

A single large, unplanned expense can completely wreck your carefully crafted monthly budget. It can force you to pull money from other important categories, like groceries or savings.

By treating annual expenses separately, you protect the integrity of your day-to-day financial plan. Your monthly budget remains stable and predictable.

This stability is a key reason why learning how to budget for annual expenses is so crucial.

Step-by-Step Guide on How to Budget for Annual Expenses

The process of planning for these costs is straightforward and systematic. This step-by-step guide will provide a clear roadmap to follow, making the task of learning how to budget for annual expenses feel simple and achievable.

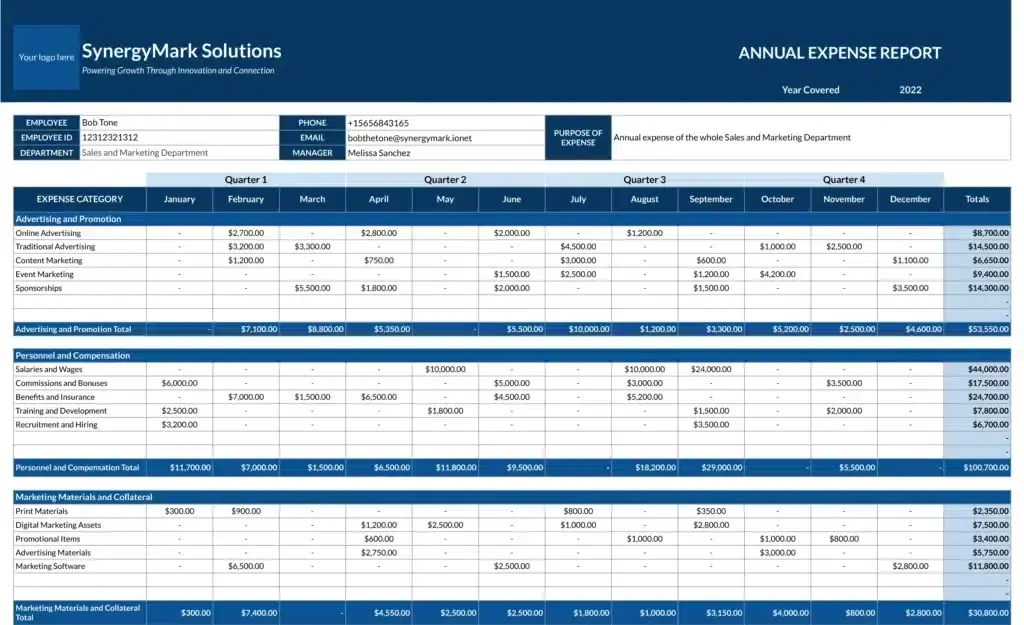

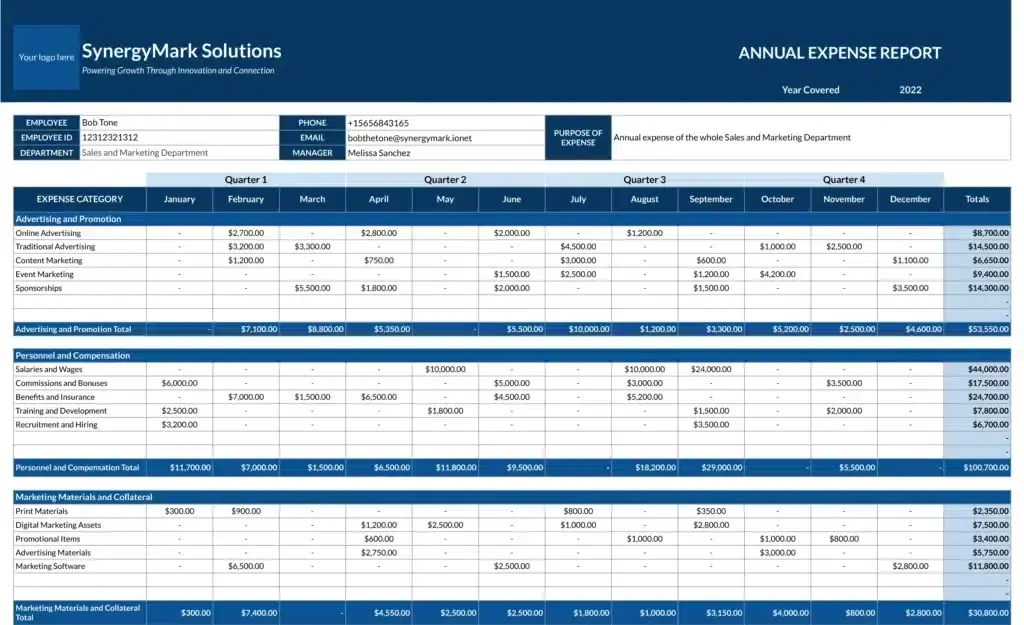

1. Step 1: Identify and List All Your Annual Expenses

Go through your bank and credit card statements from the last 12 months. Make a list of every expense that doesn’t occur on a monthly basis.

Common examples include: annual insurance premiums (car, home, life), property taxes, holiday gifts, vacation costs, professional membership fees, and car registration.

This comprehensive list is the foundation of your plan for how to budget for annual expenses.

2. Step 2: Calculate the Total and Monthly Savings Amount

Once you have your list, add up the total cost of all these expenses for the entire year. This gives you your total annual spending target.

Now, divide this total amount by 12. This is the amount of money you need to save each month to cover all these costs.

This monthly savings amount is a crucial number. It’s the core of your strategy for how to budget for annual expenses.

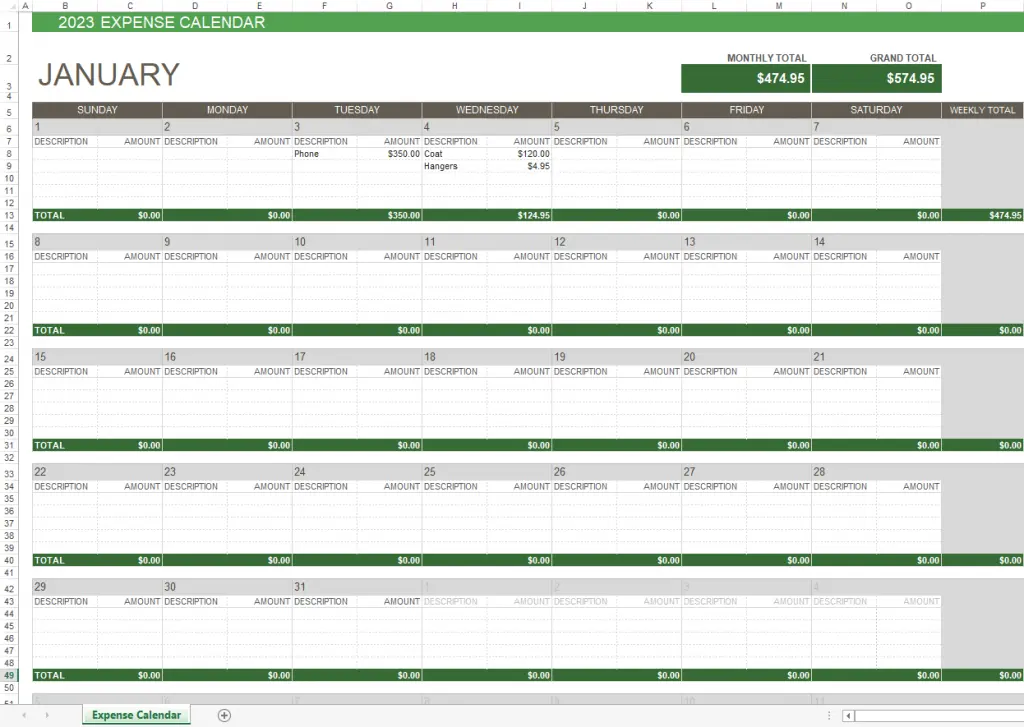

3. Step 3: Create “Sinking Funds”

A sinking fund is a savings account for a specific purpose. You should create a separate sinking fund for each major annual expense category.

For example, you could have a “Vacation Fund,” a “Car Insurance Fund,” and a “Holiday Fund.” You can do this with separate savings accounts or by using a budgeting app.

Sinking funds are the most effective tool for managing this process. They are essential for anyone learning how to budget for annual expenses.

4. Step 4: Automate Your Monthly Contributions

Treat your monthly savings amount as a non-negotiable bill. Set up automatic transfers from your main checking account to your sinking funds each payday.

This “pay yourself first” approach ensures the money is set aside before you have a chance to spend it on other things.

Automation is the key to consistency and success. It is a vital part of mastering how to budget for annual expenses.

Practical Examples for Asian Professionals

Let’s apply these steps to some real-world scenarios that are common for professionals in Asia. These examples will help you better understand how to budget for annual expenses in your own life.

1. Budgeting for Lunar New Year / Chinese New Year

This is a major expense for many across Asia. It includes costs for red envelopes (ang pao), family reunion dinners, new clothes, and travel.

Estimate your total spending, let’s say $1,200. Divide that by 12, which equals $100.

You would then set up an automatic transfer of $100 each month into your “Lunar New Year Fund.” This is a perfect example of how to budget for annual expenses.

2. Budgeting for Annual Insurance Premiums

Paying insurance premiums annually is often cheaper than paying monthly. Let’s say your annual life insurance premium is $600.

Divide $600 by 12, which is $50 per month. You would save $50 each month in your “Insurance Fund.”

When the bill is due, you’ll have the full amount ready. This is a smart financial move and a key part of learning how to budget for annual expenses.

3. Budgeting for Family Vacations

Planning a family trip that costs $2,400? The monthly savings amount is $200 ($2,400 / 12).

By saving consistently, you can pay for your entire vacation with cash. This allows you to truly relax without worrying about credit card debt.

This proactive planning is what makes mastering how to budget for annual expenses so rewarding.

Conclusion

Learning how to budget for annual expenses is a transformative financial skill that moves you from a reactive to a proactive mindset. By identifying your costs, calculating a monthly savings goal, and using automated sinking funds, you can eliminate financial surprises and reduce stress. This method protects your monthly budget and keeps you out of debt. We at Financial Forms For Asia believe that mastering how to budget for annual expenses is a cornerstone of financial stability. Start your plan on how to budget for annual expenses today and experience true peace of mind.